In the aftermath of the global financial crisis of 2008-2009, the Basel Committee of Banking Supervision (BCBS) substantially reformed the existing capital adequacy guidelines to new framework referred as Basel III with objectives.

- to strengthen global capital & liquidity rules with the goal of promoting a more resilient banking sector

- to improve the banking sector’s ability to absorb shocks arising from financial & economic stress

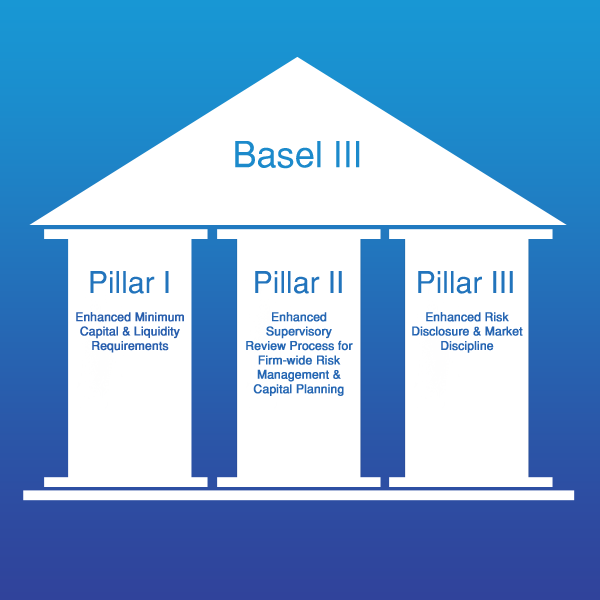

Key Basel III components impact three areas:

New definitions for Capital ratios and minimum targets, Additional RWA requirements, and New liquidity standards.